Venture capital investment in UK tech continues to grow in 2020 - Tech Nation Report 2021 summary -

4 min read

30 March 2021

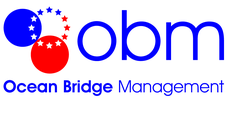

Investors may be interested to hear about the recent data published in this year’s report by Tech Nation, the UK government-funded research organisation, which shows that UK tech venture capital (VC) investment is now third in the world, after China and the US. Venture capital investment in UK tech start-ups grew in 2020 despite uncertainties such as Brexit and the Covid-19 pandemic. In 2020, UK deep tech investment rose and is ranked third in the world, and UK tech investment by sector highlights large increases in transport, energy and security funding. An interesting fact is that investment into seed stage companies is decreasing as a share of overall VC funding, which makes it more difficult for start-ups to raise funds.

Here are some key facts from the report which we believe will be of interest to our clients.

Venture Capital Funding in the UK

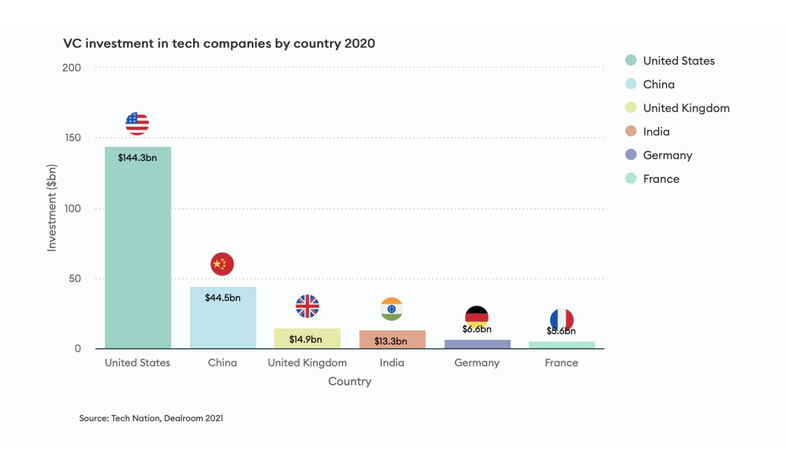

Investment from Venture Capital into the UK’s tech sector grew to a record high in 2020, rising by 7% from the previous year to $15bn despite uncertainties such as Brexit and the Covid-19 pandemic. The UK is number three in the world for tech investment behind China and the US.

VC Funding from investors outside the UK

The report shows that UK tech continues to be attractive to international investors. The data shows that 63% of all investment made into UK tech in 2020 came from overseas. Investment from outside the UK has been increasing since 2016 and peaked in 2019, with small 6% drop in 2020 when domestic investment made up a slightly higher proportion of the total.

The UK ranks highly in the top European cities for VC investment in tech companies

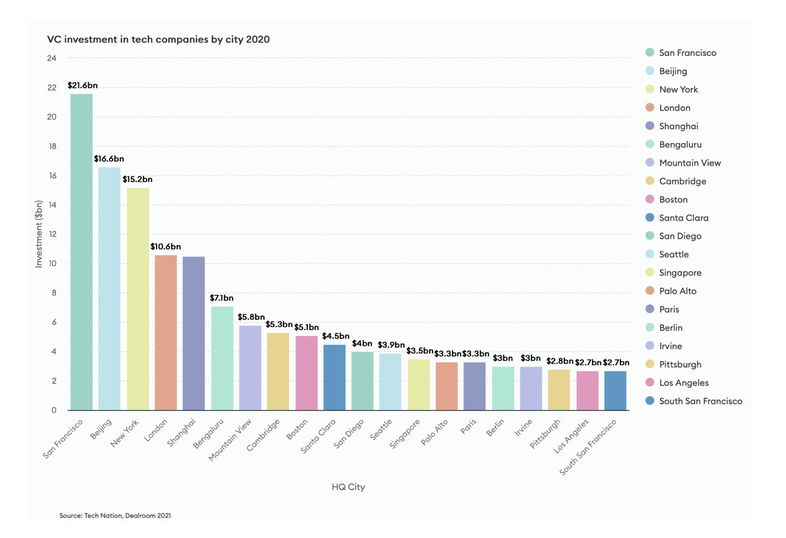

It was also reported that London leads Europe for tech investment, with higher VC investment in 2020 than Berlin or Paris. London is fourth globally for VC investment into tech by city, ahead of both Shanghai (5th) and Hangzhou (40th) in China, which have both outperformed London between 2015 and 2018.

Investment in UK emerging health tech (using technologies such as AI, quantum, AR / VR and advanced computing) in the UK has increased by 300% to over $1.5bn in 2020. Funding of emerging climate tech reached just under $800m in 2020, an increase of over 20% from 2019.

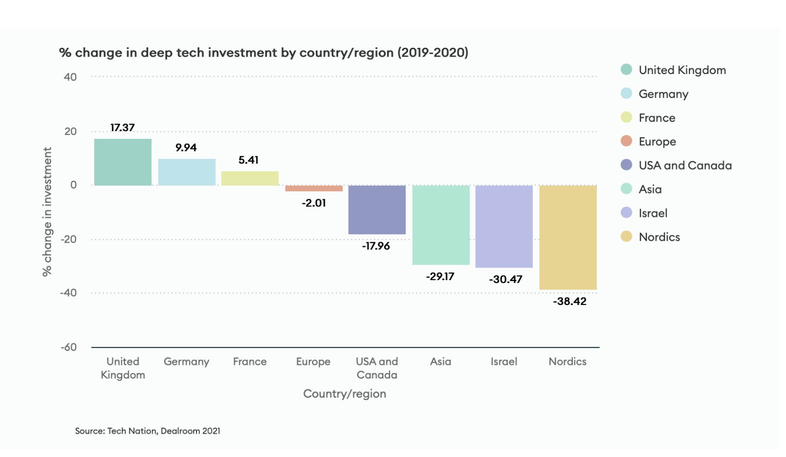

UK deep tech investment rose by 17% in 2020, the highest rate of growth globally

The report highlights that UK deep tech investment is a third globally, after China and the US and has risen significantly in 2020 whist at the same time other countries have seen reduced levels of investment. That said, the level of deep tech investment in the US is nearly 10 times that of the UK.

Deep tech companies provide technology solutions based on substantial scientific or engineering challenges which usually require significant R&D, and large capital investment. They typically address big societal and environmental challenges and have potential to impact everyday life.

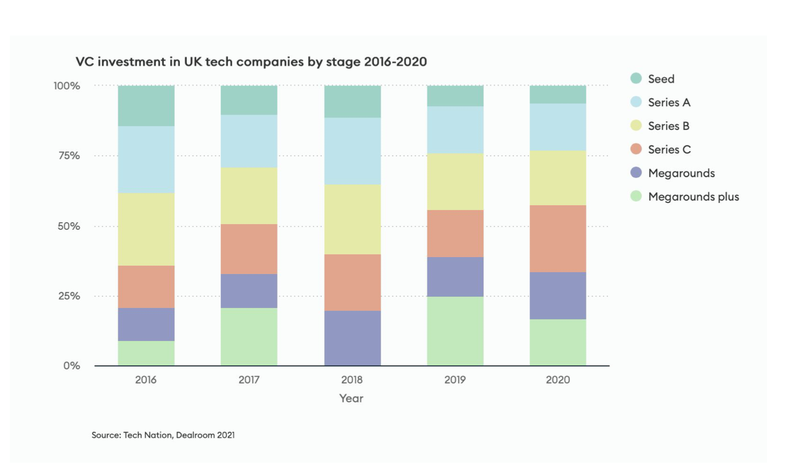

Investment in seed stage companies is decreasing and larger investment rounds are increasing

A recent trend in the size of investment rounds in the UK has continued in 2020 where investment in seed stage companies is decreasing as a proportion of overall tech VC investment, and the proportion of series B and C investment is rising. It is consequently becoming more challenging for early-stage companies to find funding.

We have heard similar stories from UK startups we know. It is partially because investors have become cautious about seed-level investment due to Covid uncertainties. On the other hand, many start-ups’ projects and orders have been delayed or cancelled due to the pandemic, impacting the whole company’s operations.

Evidence of changes in investment sector have also been noted in 2020. The VC investment rankings suggest that Fintech decreased, health tech showed a small increase while transport tech increased by +160% year on year from 2019, energy by +20%, and security by +66%.

Despite the disruption due to Brexit and the Covid-19 pandemic, the amount of venture capital investment in UK tech companies reached an all-time high in 2020. The UK is strengthening its position as a centre for tech start-up investment.

If you are interested in collaborating with the UK tech ecosystem, then please contact us.

Tech Nation Report 2021 can be found here.